A Guide to Personal Injury Settlement Trusts and Financial Recovery

Post Preview

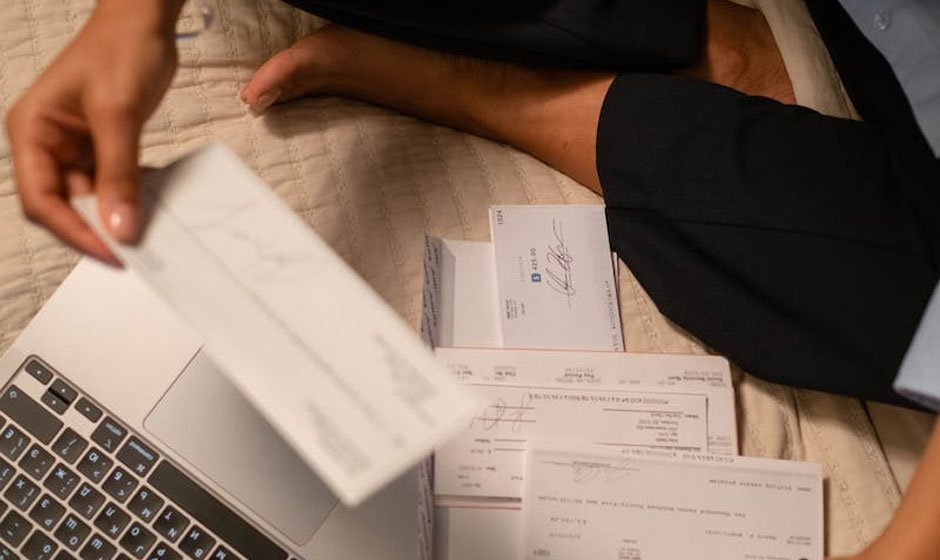

Financial consequences can be daunting when dealing with the aftermath of a personal injury. Seeking fair compensation through legal channels usually results in a court verdict or a settlement agreement. Once these funds are awarded, managing that sum to ensure long-term recovery and well-being is crucial. A personal injury settlement trust offers a secure method of managing the financial aspects of restitution, isolating the settlement funds from potential risks, and optimizing resources to support the injured party’s current and future needs.

What Is a Personal Injury Settlement Trust?

A Personal Injury Settlement Trust is a legally binding arrangement where a trustee is appointed to manage the funds received from a personal injury case on behalf of the injured party—the beneficiary. This arrangement is especially beneficial in maintaining the financial health of individuals facing a long-term loss of income or who have accrued significant medical bills. It is a thoughtful structure designed to safeguard the compensation and to ensure that it serves the intended purpose of catering to the victim’s needs over time rather than being eroded by poor financial decisions or external claims.

The Benefits of Utilizing Settlement Trusts

The establishment of a trust offers several compelling benefits. It serves as a protective buffer for the beneficiary, enabling strategic financial management and planning without direct exposure to the funds, thereby diminishing the risk of impulsive or ill-advised spending. Furthermore, the intrinsic structure of such trusts protects the assets from creditors. It preserves the beneficiary’s rights to means-tested government benefits, such as Medicaid or Supplemental Security Income (SSI), which could otherwise jeopardize the sudden influx of funds. Settling into a financial rhythm with managed distributions from a trust also alleviates the mental burden of extensive sum management, allowing the beneficiary to focus on recovery and rehabilitation.

Choosing the Right Trustee

At the heart of a Personal Injury Settlement Trust’s success is appointing a competent, responsible trustee. This individual or institution is entrusted with a grave responsibility: managing and safeguarding another’s financial future. Choosing someone with a robust financial background, undoubted integrity, and clear communication skills is essential. Often, selecting a professional trustee, such as a bank or a trust company, can lend an additional layer of security and expertise, offering peace of mind that the financial affairs related to the settlement are being competently handled.

How Settlement Trusts Differ from Other Trusts

Distinguishing Personal Injury Settlement Trusts from their counterparts is crucial to appreciate their specialized nature. Unlike other trusts created for tax benefits or wealth distribution, settlement trusts are designed to cater to personal injury victims’ needs. The specifications of the trust can address issues such as periodic medical payments, accessibility for sudden expenses related to the injury, and long-term financial stability, thereby informing the investment and distribution strategies employed by the trustee.

Investment Strategies for Settlement Trusts

The imperative of investment management is integrated within the trust’s objectives. Settlement trust funds should be invested with care to balance growth and safety. It is often wise to pursue a diversified portfolio, hedging against market volatility while ensuring liquidity. Participants in constructing such investments should never forget the primary goal: financial provisions for the beneficiary that affords stability and potential for modest appreciation over time.

Tax Implications of Settlement Trusts

Understanding the implications of taxes on settlement trusts is another vital aspect of financial stewardship. How a trust is structured can significantly influence tax liabilities. Trusts may be subject to various forms of taxation, which can erode the funds within. Thus, it is important to engage in astute tax planning, potentially with the assistance of a professional tax advisor, to ensure that the beneficiary’s funds are protected from excessive taxation, thereby maximizing the amount available for their essential needs.

Understanding Legal Requirements

Meticulous attention to legal mandates is a prerequisite for establishing and maintaining a settlement trust. Both federal and state legislations dictate the conduct and expectations of a trust’s operations. A thorough understanding of these laws, including how funds may be disbursed and reported, is indispensable for trustees to avoid legal pitfalls and maintain the trust’s integrity. Keeping abreast of changes in legislation also ensures that the trust continues to serve its protective and supportive role without interruption.

Real-Life Success Stories of Settlement Trusts

The utility of Personal Injury Settlement Trusts is made tangible through their success stories. Beneficiaries have been able to navigate through traumatic periods with the assurance that their financial assets are secure and well-managed. For many, the trust represents much more than a financial tool; it embodies a lifeline that has facilitated access to necessary medical treatments and has provided a semblance of normalcy in their fiscal routines. Each narrative underscores the importance of strategic planning and careful administration of settlement trusts in empowering individuals in the wake of personal adversity.

Individuals and trustees looking to grasp the broader context of Personal Injury Settlement Trusts may lean on comprehensive analyses and updates. For an insightful perspective on the financial dimension, one might consider the reports by financial experts in the field. Equally, staying informed through resources such as legal platforms that provide in-depth coverage of legal standards and case studies can be invaluable to keep on top of the evolving legal frameworks that affect these financial instruments. These resources ensure that settlement trusts fulfill their role effectively, offering beneficiaries a semblance of assurance in often tumultuous times.