Why You Should Read About Compound Interest to Grow Your Wealth

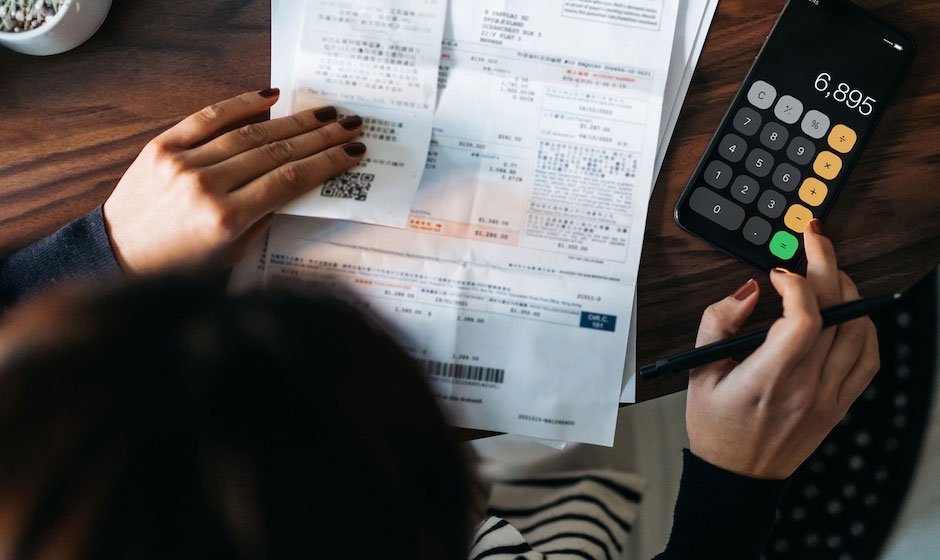

Learning the basics of compound interest can transform your approach to finances. It’s not merely about math but understanding how money, with time, builds on itself, opening a doorway to financial freedom. Secure your financial future by exploring z-lib finance collection, where knowledge about such key topics awaits. For anyone seeking to grow their wealth wisely, diving into the fundamentals of compound interest offers clarity and direction.

The Power of Compound Interest in Wealth Building

Compound interest may seem like an abstract term, yet it’s a concept that holds incredible power for financial growth. Instead of your money growing at a steady rate, compound interest causes it to accelerate as time goes on. Imagine it like a snowball rolling down a hill—starting small, it builds speed and size the farther it travels. When you begin investing, each year sees not just your initial sum but all accrued interest expanding further, creating a cycle of growing wealth.

To grasp this, consider it this way: each bit of interest becomes part of the principal amount for the next cycle. With each new period, whether monthly, quarterly, or yearly, the interest generates more value than it did in the last. Over long periods, this small yet steady accumulation can lead to significant wealth, provided one exercises patience and financial discipline. Engaging with books and resources on zlibrary allows readers to explore how compound interest strategies fit personal goals, helping them to identify the right investments and timelines.

Why Knowledge of Compound Interest Is Essential

Understanding compound interest is not just for mathematicians or economists. It’s a practical skill that offers everyday people the insight needed to make wiser choices. This knowledge helps guide financial decisions, from choosing a savings account to investing in stocks or bonds, allowing one to forecast potential growth.

Let’s delve into some reasons why compound interest knowledge is invaluable:

- Long-term gains through patience: Compound interest rewards those who commit to a long-term approach, making it ideal for retirement or future savings.

- Enhanced control over finances: By knowing how interest compounds, you can strategize around saving and spending to make your money work harder.

- Boosted confidence in investing: Familiarity with compound interest builds trust in investments, especially in riskier markets where patience reaps benefits.

- Securing generational wealth: Compounding over decades creates substantial wealth, which can benefit not only you but future generations as well.

- Protection against inflation: Compound interest helps savings keep pace with inflation, ensuring your money doesn’t lose value over time.

Each of these factors builds the foundation of financial independence, making compound interest a skill worth mastering. Gaining these insights through carefully curated resources available on zlibrary can open doors to understanding and applying these strategies.

Practical Applications of Compound Interest

Compound interest applies not only to wealth creation but also to other aspects of personal finance. For example, credit card debt works similarly but in reverse—accumulating debt grows rapidly over time, a cautionary tale of how compounding affects all financial aspects. When you grasp the dual nature of compound interest, you become better prepared to handle both investments and liabilities.

Seeking out materials on Z lib can provide in-depth guidance on maximizing compound interest benefits and minimizing the impact of compounded debts. This dual awareness allows individuals to pursue opportunities without the fear of financial missteps.

Ultimately, compound interest is more than a concept. It’s a tool that helps people pave a solid path to financial well-being by enhancing their financial understanding and decision-making skills.